AMEX/TSX:URZ |  | Pure-Play Uranium - Nichols Ranch ISR Mine Construction Underway & On Schedule |

Uranerz Energy Stock - shares listings, averages and distribution

|   | ||||||||||||||||||||||||||||||||||||

URZ Top 10 Institutional Holders: Global X Management Company LLC, BlackRock Fund Advisors, State Street Corporation, Northern Trust Corporation, BlackRock Institutional Trust Company NA, The Vanguard Group Inc, CQS Cayman Limited Partnership, Royal Bank of Canada, Andreeff Equity Advisors LLC, TIAA-CREF Investment Management LLC.

URZ Top 10 Mutual Fund Holders: Global X Funds-Global X Uranium ETF, IShares Russell 2000 Index Fund, SunAmerica Focused Small Cap Value Fund, Vanguard Total Stock Market Index Fund, IShares Russell 2000 Growth Index Fund, College Retirement Equities Fund-Stock Account, Valic Company II-Small Cap Value Fund, IShares Russell Micro Cap Index Fund, EQ Advisors Trust-EQ/Alliance Bernstein Small Cap Growth Portfolio, Bridgeway Funds Inc-Ultra Small Company Market Fund.

Top of Page

Uranerz Energy Recent Headlines - news releases and research analysts reports

News Releases

- January 18, 2012 - 9:00 AM EST Uranerz Reports Production Well Installation Update - Marketwire

- December 19, 2011 - 9:01 AM EST Uranerz Provides ISR Uranium Mine Construction Update - Marketwire

- November 30, 2011 - 9:00 AM EST Uranerz Signs Processing Agreement with Cameco - Marketwire

- November 10, 2011 - 9:55 AM EST Uranerz Announces Third Quarter Financial Results - Marketwire

- August 10, 2011 - 9:00 AM EST Uranerz Announces Second Quarter Financial Results - Marketwire

- August 1, 2011 - 9:00 AM EST Uranerz Commences ISR Uranium Mine Construction - Marketwire

- July 20, 2011 - 12:47 PM EST Uranerz Receives Final NRC Approval - Marketwire

- June 28, 2011 - 9:03 AM EST Uranerz Included in the Russell Family of Indexes - Marketwire

- May 10, 2011 - 9:02 AM EST Uranerz Initiates 2011 Powder River Basin Drilling Program - Marketwire

- May 3, 2011 - 9:03 AM EST Uranerz Energy Corporation Letter to Shareholders - Marketwire

- April 7, 2011 - 8:16 AM EST Uranium Stocks Gain Momentum as Growth Strategies Remain Intact - The Bedford Report Provides Analyst Research on Denison Mines and Uranerz Energy - Marketwire

- March 2, 2011 - 9:01 AM EST Uranerz Treasury Increases to $47 Million from Exercised Warrants - Marketwire

- January 26, 2011 - 5:01 PM EST Uranerz Announces Accelerated Expiry Date of Warrants - Marketwire

- January 24, 2011 - 3:30 PM EST Uranerz Energy Corporation: NRC Determines No Major Environmental Impacts Preclude Licensing of Nichols Ranch ISR Uranium Project - Marketwire

- January 4, 2011 - 9:01 AM EST Uranerz Receives WDEQ Permit to Mine for Nichols Ranch Uranium Project - Marketwire

Research Analysts Reports

- Haywood Securities - Geordie Mark 1/19/2012

- Dundee Securities - David Talbot 12/02/2011

- Dahlman Rose - Anthony Young 07/20/2011

About Uranerz Energy - overview, investment highlights, sales agreements, production profile and company objectives

Overview

"Uranerz" literally means "uranium ore", in German. Uranerz is pronounced "your honors", like addressing judges in a court of law.

Uranerz Energy Corporation is a pure-play uranium company listed on the NYSE Amex Exchange and the Toronto Stock Exchange under the symbol "URZ", and is also listed on the Frankfurt Stock Exchange under the symbol "U9E". Click the quote links in the tables above to get up-to-date stock prices and other information about the company and its common shares.

Uranerz is a U.S. mining company focused on near-term commercial In-Situ Recovery ("ISR") uranium production, and is currently constructing its first ISR mine in Wyoming, one the first new commercial uranium mines built in almost 20 years. ISR is a mining process that uses a "leaching solution" to extract uranium from sandstone uranium deposits; it is the generally accepted extraction technology used in the Powder River Basin ("PRB") area of Wyoming (ISR comprised 41% of world uranium production in 2011).

The Company controls a large strategic land position in the Pumpkin Buttes Uranium Mining District of the central PRB of Wyoming. Uranerz' management team has specialized expertise in the ISR uranium mining method, and a record of licensing, constructing, and operating ISR uranium projects. Uranerz received its NRC license on July 20, 2011 and commenced construction on August 2, 2011.

As of December 7, 2011, Uranerz' mine site infrastructure completion status is: access road 100%, construction power 100%, water supply 100%, cement silo 100%, earthwork (plant, office, shop) 85%, concrete 97%, wellfield 7%, building erection 30%, processing plant installation 10%, header houses 3%. The Company has also entered into long-term uranium sales contracts for a portion of its planned production with Exelon and one other of the largest nuclear utilities in the country.

Investment Highlights

- Received all federal and Wyoming State permits for mine construction;

- Commenced mine construction in Q3 2011;

- Projected to commence ISR uranium production in H2 2012;

- Experienced management and operations team in place;

- Well-financed for construction with over US$36 million in the treasury and no debt;

- Controls a large strategic land position;

- Signed long-term off-take agreements for a portion of production with two major US-based nuclear operators, including Exelon

- Cameco uranium-loaded resin processing agreement in place.

- Continuing to expand resource base through drilling and/or acquisitions.

Sales Agreements

- Uranerz has entered into uranium off-take agreements with 2 major nuclear operators in the US, including Exelon which operates the largest nuclear fleet in the US and the third largest fleet in the world

- Both agreements are long-term contracts with deliveries over a nine year period; portion of planned production

- The contracts have flexible start dates for deliveries

- The contracts include: one with fixed escalating prices, and the other uses a combination of spot and long-term prices with a floor and a ceiling

Production Profile

Uranerz Energy's Nichols Ranch processing facility has permits to be licensed for a maximum annual production level of two million pounds of yellowcake (U3O8). With ISR uranium production estimated to commence in H2 2012, the company's initial targeted production level is 600,000 to 800,000 pounds per year, rising to 1.5 million pounds per year in 2018.

Yearly targeted production: 2012 300k, 2013 700k, 2014 800k, 2015 900k, 2016 1.2m, 2017 1.4m, 2018 - 2022 1.5m lbs.

Uranerz has key advantages in that it can expand its production profile via permit amendment provisions, providing cost savings and synergies with potential nearby satellite operations, some that potentially only require a wellfield and pipeline solution to the company's centrally located Nichols Ranch processing plant. These properties include: Jane Dough, Reno Creek, West North-Butte, North Rolling Pin and Willow Creek.

Company Objectives

- Complete ISR mine construction on schedule

- Commence commercial ISR uranium production in 2012

- Continue exploring and adding to resource base

- Develop satellite deposits to increase and extend production pipeline

- Continue evaluating property acquisitions, particularly in the Powder River Basin

Top of Page

Uranerz Energy Value Proposition - PRB properties, advanced projects, uranium resources and producers vs. URZ' stock

PRB Properties - Powder River Basin, Wyoming USA

- Hosts some of the highest grade ISR-amenable deposits in the State

- Property potential validated by the presence of Cameco and Uranium One

- Since 1986, all Wyoming ISR production has been sourced from the PRB

- Project acquisitions concentrated on areas of known uranium mineralization

Advanced Projects

The following Claim Legend shows: Uranerz Energy Corporation's, Cameco Resources' and Uranium One's land positions in the Central Powder River Basin, Wyoming, USA, as of October 2011. Also see Uranerz Energy's 'Permitted' and 'Being Permitted' project units.

Uranerz is focused on achieving near-term commercial in-situ recovery ("ISR") uranium production in Wyoming, the largest producer of uranium of any U.S. State. Uranerz owns or controls approximately 93,115 acres (37,682 hectares or 145 square miles) in the Pumpkin Buttes Uranium Mining District of the Central Powder River Basin of Wyoming, U.S.A., an area well-known for hosting uranium-mineralized roll fronts often amenable to ISR mining techniques.

Uranerz has over 30 wholly-owned and joint-ventured projects in the Powder River Basin of Wyoming. The Powder River Basin of Wyoming has some of the highest grade uranium deposits in the State that are amenable to the cost-effective in-situ recovery mining methods. Commercial ISR mining in the Powder River Basin has been ongoing since 1987, with current production coming from Cameco's Smith Ranch-Highland mines and Uranium One's Irigaray/Christensen Ranch ISR mine.

The Company also has an 81% interest in the NAMMCO properties, which cover approximately 66,972 acres (27,102 hectares) in the central Powder River Basin (collectively, the "Arkose Property"). In connection with this acquisition, the Company and United Nuclear, LLC, a limited liability company owned by the sellers of the NAMMCO properties, have formed and contributed their interests in the NAMMCO properties to the "Arkose Mining Venture". United Nuclear will hold (and contribute to) a 19% working interest in the Arkose Mining Venture. The Arkose Property is located in close proximity to the Company's 100%-owned properties in the Powder River Basin, including adjacent Collins Draw and Doughstick and other nearby properties that have been the subject of the Company's recent exploration and mine licensing efforts.

As operator of the Arkose Mining Venture, the Company continues to conduct aggressive exploration drilling programs to identify new uranium mineralized trends and to further delineate known resources. These exploration results can be used to generate data for future permit applications and eventual ISR mining operations.

Uranium Resources

Uranerz Energy Corporation has reported NI 43-101 uranium resources for seven of its over 30 uranium projects in the Powder River Basin area of Wyoming, U.S.A. The table below shows the Company's total estimated uranium resources of over 19 million pounds U3O8 as of October 14, 2010, on just those seven projects.

Uranerz Attributable NI 43-101 Resources Table

| Property Name | Pounds eU3O8 Measured & Indicated | Average Grade % eU3o8 | Pounds eU3o8 Inferred | Average Grade % eU3o8 | Date of 43-101 Report or Update |

|---|---|---|---|---|---|

| Reno Creek | 4,292,948 | 0.056 | 142,167 | 0.039 | October 13, 2010 |

| South Doughstick | 1,852,673 | 0.121 | 153,337 | 0.096 | February 25, 2010 |

| Doughstick Properties | 882,736 | 0.081 | 86,909 | 0.055 | January 26, 2010 |

| Nichols Ranch | 2,949,546 | 0.114 | - | - | June 5, 2009 |

| Hank | 2,236,050 | 0.123 | 246,753 | 0.087 | May 1, 2008 |

| West North-Butte | 2,837,015 | 0.153 | 2,681,928 | 0.120 | December 9, 2008 |

| North Rolling Pin | 664,521 | 0.058 | 32,522 | 0.042 | June 4, 2010 |

| TOTALS | 15,715,489 | 0.103 | 3,343,616 | 0.111 |

From Uranerz Energy's January 4, 2011 new release, "... The Nichols Ranch project contains an estimated 5.5 million pounds of uranium resources and will serve as a platform to develop the Company's other Powder River Basin projects through the permit amendment provisions of the regulatory process. ..."

The central processing facility at the Company's Nichols Ranch ISR Uranium Project is being licensed for a capacity of 2 million pounds per year of uranium (as U3O8). It is planned that this facility will process uranium-bearing well field solutions from Nichols Ranch, as well as uranium-loaded resin transported from the Hank satellite facility, plus uranium-loaded resin from any additional satellite deposits that may be developed on the Company's other Powder River Basin properties. This centralized design enhances the economics of the Company's potential additional satellite projects by maximizing production capacity while minimizing further capital expenditures on processing facilities.

With the state required regulatory approvals having been achieved in January 2011, and the final NRC construction permit in place on July 20, construction of the company's first uranium mine commenced August 1, 2011. As of this date, mine construction remains on schedule, with commencement of operations at the Nichols Ranch ISR Uranium Project currently forecasted for the second half of 2012.

Producers vs. Uranerz Energy's Stock - (click any symbol for current stock quote

| Company Name | Exch. | Symb. | Quote |

Market Cap.

| EPS | P/E | Div./Sh. | Yield |

| Areva | Paris | AREVA | E18.96 | E 7.5 Billion | -- | -- | -- | -- |

| Cameco | NYSE | CCJ | $23.77 | $ 9.4 Billion | $ 1.03 | 23.20 | $ 0.39 | 1.65 % |

| Rio Tinto | NYSE | RIO | $59.99 | $118 Billion | $ 7.26 | 8.30 | $ 1.07 | 1.79 % |

| BHP Billiton | NYSE | BHP | $80.15 | $214 Billion | $ 8.54 | 9.40 | $ 2.20 | 2.75 % |

| Uranium One | TSX | UUU | $ 2.80 | $ 2.7 Billion | $-0.16 | -- | $ 0.00 | 0.00 % |

| Paladin Energy | TSX | PDN | $ 1.85 | $ 1.6 Billion | $-0.26 | -- | $ 0.00 | 0.00 % |

| Denison Mines | TSX | DML | $ 1.83 | $ 704 Million | $-0.03 | -- | $ 0.00 | 0.00 % |

| Uranium Energy | AMEX | UEC | $ 4.10 | $ 310 Million | $-0.30 | -- | $ 0.00 | 0.00 % |

| Uranerz Energy | AMEX | URZ | $ 2.68 | $ 207 Million | $-0.20 | -- | $ 0.00 | 0.00 % |

The number of pure-play uranium stocks is relatively small, with just a few major players controlling the majority of uranium production worldwide. Even within the table above, the largest companies by market capitalization (Rio Tinto and BHP Billiton) are better known for their mining of base metals, precious metals, gem-stones or other commodities, than solely for their uranium production.

Uranium producers seem like an exclusive club, that the biggest members may want to keep that way. A Special to Globe and Mail Update published January 27, 2010, entitled "THE BIG PICTURE - Owning uranium producers could be a long-term energy strategy", reported that "Junior companies that have found, or are developing, large deposits of uranium are acquisition targets for larger producers or users in countries eager to secure supplies..."

These insights seem to be coming true as evidenced by last fall's bidding war by (TSX: CCO)(NYSE: CCJ) Cameco Corp. and (NYSE: RIO) Rio Tinto over (TSX: HAT) Hathor Exploration and its high-grade uranium Roughrider deposit located in Canada's Athabasca Basin. Rio Tinto won and is now completing its approximately C$654 million acquisition of Hathor at C$4.70 per share. Uranerz Energy also has advanced uranium projects with both established resources and significant exploration potential, plus near term production with experienced management and millions in the treasury. URZ's market-cap is around $200 million, but it is not quite yet producing uranium. The producers in the table above start at a market-cap of around $300 million, to as high as over $200 billion.

Top of Page

Uranerz Energy Key Personnel - background, executive officers, board of directors and investor relations

Background

In July 2005 management changed its corporate name to "Uranerz Energy Corporation". Uranerz is an identity that most of the current management had worked with before, as former officers, senior management and employees of the original Uranerz Exploration and Mining Limited and related companies (the "Uranerz Group").

The Uranerz Group was the world's third largest uranium producer when it was acquired in 1998 by Cameco, the world's largest primary uranium producer. This management team has the experience, the contacts, the ability, the competency and the desire to build Uranerz Energy into a significant producer of uranium. The Company also has an advisory board that consists entirely of ex-Uranerz Group professionals.

Dennis Higgs, B.Com. - Executive Chairman Mr. Higgs has been involved in the financial and venture capital markets for over twenty-five years, raising millions of dollars in the United States, Canada and Europe. He founded his first junior exploration company in 1983 and took it public through an initial public offering in 1984. Since then, Mr. Higgs has been involved in the founding, financing, initial public listing, and building of several companies. Mr. Higgs was directly involved with the founding and initial public offering of Arizona Star Resource Corp. and the listing and financing of BioSource International Inc. In July 1990, Mr. Higgs established Senate Capital Group Inc., a private venture capital and management consulting company. With this company, his focus is on the creation and funding of seed and early-stage companies with sound projects and good management. More specifically, Mr. Higgs helps formulate the business strategy and, if necessary, assemble the team to successfully maneuver these companies through the critical early stages of raising sufficient funding to meet their needs. At the same time, he emphasizes and facilitates the companies' listings on a stock exchange to provide additional funding sources to those companies. At present, Mr. Higgs also serves as a director of Miranda Gold Corp., a Canadian public gold exploration company, which he founded in May 1993 (TSX-V: "MAD"). |

Glenn Catchpole, M.S., P.Eng. - President, Chief Executive Officer Mr. Catchpole is a licensed engineer who holds an M.S. in civil engineering from Colorado State University. He has been active in the uranium solution mining industry since 1978, holding various positions including well field engineer, project manager, general manager and managing director of several uranium solution mining operations. In 1988 Mr. Catchpole joined Uranerz U.S.A., Inc. and Uranerz Exploration and Mining and became Director of Regulatory Affairs, Environmental Engineering and Solution Mining. Mr. Catchpole's responsibilities included the monitoring and oversight of the environmental and regulatory aspects of two large uranium mines in Canada and the operational aspects of one uranium solution mine in the United States. In 1996 Mr. Catchpole was appointed General Manager and Managing Director of the Inkai uranium solution mining project located in the Republic of Kazakhstan (Central Asia). In 1998 Cameco Corporation acquired Uranerz U.S.A. Inc., and Mr. Catchpole continued his post at the Inkai Project for Cameco. Mr. Catchpole spent six years taking the Inkai project from acquisition through feasibility study, joint venture formulation, government licensing, environmental permitting, design, construction and the first phase start-up. Following his departure from Cameco in 2002, Mr. Catchpole was an independent consulting engineer providing project management to the oil and gas, mining, and construction industries. Mr. Catchpole is experienced in all phases of project development including environmental permitting, procurement, scheduling, budgeting, and construction of infrastructure and main facilities. He has served on numerous mineral evaluation and due diligence teams. |

George J. Hartman, M.S. - Executive Vice President, Chief Operating Officer Mr. Hartman has thirty-seven years experience developing metals and industrial mineral projects from the greenfields stage to production. He has an M. S. degree in Mineral Economics (Colorado School of Mines) and a B. S. in Chemical Engineering (University of Denver). Four process patents have been granted in his name. His experience includes thirteen years managing several in-situ leach uranium mines from green field exploration sites through commercial production. For the past fourteen years Mr. Hartman was General Manager for Fort Cady Minerals Corporation where he had complete responsibility for solution mining and process development, permitting, design, procurement, construction, production and property management. Property management included federal mining claims and private leases for a large deposit of borate mineral. He managed the project from test stage through construction and operation of a demonstration production facility. He was also involved with product marketing. From 1982 to 1989 Mr. Hartman was General Manager, In-Situ Leach Projects, for Uranerz USA. During this period he managed the interests of all in-situ uranium projects which Uranerz USA owned including Ruth, Crow Butte, and North Butte. Under his management, Uranerz served as the contract operator for the successful test solution mining of the Christenson Ranch uranium property now owned by Uranium One. He was on the Uranerz acquisition team that studied potential uranium and precious and base metal properties in Nebraska, Colorado, Texas, New Mexico, Utah, California and Wyoming. Prior to joining Uranerz, Mr. Hartman was president of Ogle Petroleum Inc. where he was in overall operating charge of this uranium production company that joint ventured with Duke Power on a commercial solution mine in Wyoming. He was responsible for managing the project from green field exploration through commercial production (shipped filtered yellowcake to the converter). Mr. Hartman personally designed the processing plant facilities. Previous to his work with Uranerz, Mr. Hartman was the Texas Mines Manager for Wyoming Mineral Corporation (Westinghouse), where he was responsible for the management of two production in-situ uranium mines with ion exchange processing plants in Bruni, and Three Rivers, Texas (shipped dried yellow cake to the converter). |

Benjamin D Leboe, CA, CMC - Senior Vice President, Finance and Chief Financial Officer Mr. Ben Leboe was a senior consultant, management consulting of the Business Development Bank of Canada, from January 2005 to February 2006. Previously, Mr. Leboe was president, secretary, treasurer, principal financial and accounting officer and a director of Asia Payment Systems Inc., a United States and Hong Kong based company engaged in payment processing services and related applications from June 1998 to January 2005. Concurrently, from January 2003 to January 2005, Mr. Leboe was the chief financial officer of C-Chip Technologies Inc. (now Manaris Corporation), a Montreal based corporation developing high-tech products and services for security and risk mitigation activities. Mr. Leboe has been the principal of Independent Management Consultants of British Columbia from 1990 to date. Concurrently, Mr. Leboe was previously vice-president and chief financial officer of VECW Industries Ltd. from 1990 to 1993, and a partner of KPMG Consulting from 1978 to 1990. Mr. Leboe received his bachelor of commerce degree from the University of British Columbia. Mr. Leboe is a chartered accountant and a certified management consultant in the Province of British Columbia. Mr. Leboe has been appointed Ethics Officer of Uranerz Energy. |

Kurtis Brown, B.A., P.G. - Senior Vice President, Exploration Mr. Brown, a 35 year veteran in the mineral extraction industry, started his uranium geology career with the OPI-Western Joint Venture in Wyoming in 1977. He managed the exploration program in the Great Divide Basin for the Joint Venture delineating over 20 million pounds of uranium resources. Mr. Brown later became the well field engineer for the OPI-Western Joint Venture at the Bison Basin commercial In-Situ Recovery ("ISR") uranium mine. He designed and supervised the construction of some 450 monitor and mining wells for the 600 gpm (gallon per minute) mining operation. Mr. Brown managed the daily operation of the well fields, and developed innovative methods for regulating flow balance, conducting well field maintenance, and performing well work-over. He also served as the designated mine site radiation safety officer. In the mid-1980s Mr. Brown joined Malapai Resources Company (subsidiary of Arizona Public Service) working at the Willow Creek Research and Development ISR uranium test site located in the Powder River Basin of Wyoming. After the successful test mine, he was transferred to Malapai's Irigaray Mine where he assisted with the start-up of the Christensen Ranch ISR commercial uranium mine performing environmental permitting and compliance duties. While with Malapai, Mr. Brown was also involved with aquifer restoration activities at the Irigaray ISR mine. Mr. Brown joined Uranerz USA, Inc. (former Uranerz Group) in 1989 to conduct detailed feasibility studies for the proposed North Butte ISR mine. His work included well field geology, reserves estimation, design and selection of surface and down hole equipment, and cost analysis for the 2000 gpm operation. He also conducted claims assessment drilling and assisted in the procurement of required state and federal mining permits. Prior to joining Uranerz Energy Corporation full-time in 2007, Mr. Brown was a Company consultant, providing geology services including the acquistion evaluations of Great Divide and Powder River Basin projects. Mr. Brown received his Bachelor's degree in Geology from the University of Wyoming. He is a Registered Professional Geologist in Wyoming and a Certified Safety Professional. In addition to his uranium background, he has extensive experience in coal and industrial minerals mining as well as oil and gas extraction. |

Doug Hirschman, B.S. - Vice President, Land Mr. Hirschman is a graduate of the University of Wyoming and has over 30 years of experience in the mineral exploration industry serving in various capacities and most recently as Manager of Lands, International with Newmont Mining Corporation. Mr. Hirschman has supervised mineral property acquisitions, prepared and negotiated agreements including joint ventures, performed land status investigations on federal, state and private mineral interests in the Western USA, and maintained land records insuring timely satisfaction of land payments and agreement obligations. |

Sandra MacKay, LLB - Vice President, Legal and Corporate Secretary Ms. Sandra MacKay obtained her Bachelor of Laws in 1983 from the University of British Columbia. She practiced as a commercial and securities lawyer with a major Vancouver law firm before joining Chevron Canada Limited as in-house counsel. Ms. MacKay has over 20 years of experience working as counsel within business organizations in a variety of industries including petrochemical, engineering, and biotechnology. She has most recently acted as corporate counsel to QLT Inc., a Vancouver based dual listed (Nasdaq/TSX) international biotech firm and as Vice President and General Counsel to Aker Solutions Canada Inc., a Vancouver based international supplier of engineering technology which is part of the Aker group of Companies based in Oslo, Norway. Ms. MacKay has acted for both public and private companies on a wide variety of corporate-commercial transactions including acquisitions, licensing deals, and joint ventures and has provided general counsel to her clients on various subject matters including securities law compliance, employment law, corporate governance and general corporate-commercial matters. Ms. MacKay joined Uranerz in July of 2009 as Legal Counsel and Corporate Secretary and was appointed Vice President, Legal and Corporate Secretary in July of 2010. |

Gerhard F. Kirchner, Ph.D., P.Eng. - Director Dr. Kirchner has 40 years of international mine development and management experience including 20 years with Uranerz Exploration and Mining Ltd. He received a multidisciplinary education in mining engineering and economic geology, and a Doctorate in Mining Sciences from the University of Leoben, Austria. At Uranerz, Dr. Kirchner spent nine years as General Manager and 11 years as Senior Vice President. He and his team were responsible for the Key Lake uranium discovery, and the engineering and development of projects such as the Midwest uranium deposit, Eagle Point North uranium deposit, Star Lake gold deposit and the Crow Butte ISL uranium deposit. Previous to his work with Uranerz, Dr. Kirchner spent six years developing and managing the Kamoto Mine in Kolwezi, Zaire; four years consulting on mining and civil engineering projects in several countries including Surinam, Nigeria and Congo; five years as a mine superintendent and exploration manager in Greenland where he discovered the Molybdenum Porphyry Erzberg. Dr. Kirchner also spent three years as a project engineer on dams in Austria and Japan, and road projects in Saudi Arabia. |

Mr. Paul Saxton, BSc, MBA, PEng. - Director Mr. Saxton is a mining engineer who also holds an MBA from the University of Western Ontario. He has been active in the mining industry since 1969, holding various positions including mining engineer, mine superintendent, president and chief executive officer of numerous Canadian mining companies. Following 10 years with Cominco, Mr. Saxton became vice-president and president of Mascot Gold Mines Ltd., initially working on the design and construction of the Nickel Plate mine in British Columbia, Canada. Subsequently Mr. Saxton became a vice-president of Corona Corporation where he was responsible for western operations and exploration for the company and was instrumental in the re-opening of the Nickel Plate Mine. In 1989, Mr. Saxton was appointed senior vice-president of Viceroy Resource Corporation where he was responsible for helping to obtain financing and the construction and operations of the Castle Mountain mine in California. In 1994, Mr. Saxton was appointed president of Loki Gold Corporation and Baja Gold Inc. where he was responsible for arranging over $45 million in mine financing and bringing the Brewery Creek Gold mine into production. Following his departure from Viceroy in 1998, Mr. Saxton became president of Standard Mining Corp., organizing the company and supervising its exploration activities until 2001, when Standard Mining Corp. was merged with Doublestar Resources Ltd. In March 2004, Mr. Saxton was appointed as a director and president of Lincoln Gold Corporation, a company engaged in mineral exploration in Mexico and in the State of Nevada. Mr. Saxton is a member of the Nomination and Governance and Compensation committees. |

Arnold J. Dyck, C.M.A. - Director Mr. Arnold J. Dyck was employed at Uranerz Exploration and Mining Limited from 1977 to 1998. Mr. Dyck progressed through various positions with Uranerz Canada Limited, Uranerz Exploration and Mining Limited, and Uranerz U.S.A. Inc. to become the Senior Vice-President and Chief Financial Officer for the Uranerz group of companies. He also served as a member of the board of directors for Uranerz U.S.A. Inc. and as chairman of the board with a subsidiary mining company. Uranerz Exploration and Mining Limited, Uranerz Canada Limited, Uranerz U.S.A. and the original Uranerz group of companies are not connected with, or a predecessor company to Uranerz Energy Corporation. The original Uranerz group of companies was acquired by Cameco, the world's largest primary uranium producer, in 1998. Mr. Dyck is a graduate of the Registered Industrial Accountant education program and was awarded the designation of Certified Management Accountant in 1975. Mr. Dyck has been appointed to the Company's audit committee and compensation committee. |

Peter W. Bell, B.Sc., MBA - Director Mr. Peter W. Bell practiced as a licensed pharmacist until 1968. Since that time he has been a self-employed consultant and a director and member of a number of private and public companies and professional organizations. Mr. Bell is a director of Current Technology Corporation which markets an electrostatic hair maintenance and re-growth process, since 1992. Since 1997 Mr. Bell has been a director and is the President of Ezon Healthcare Corporation, a private company that is involved in the development of a graphic labeling system for pharmaceutical products. Mr. Bell has provided a wide range of consultant services to businesses and health care companies and organizations. These consultant services included: sales management and reorganization of sales force; regional market development and marketing strategy; medical opinion surveys and market analysis; medical device product market development; business immigration program presentations; management studies in healthcare organizations; development and growth of public corporations and reverse takeovers in public companies. Mr. Bell holds a Bachelor of Science Degree in Pharmacy from the University of Manitoba and a Masters in Business Administration from the University of Western Ontario. Mr. Bell has been appointed to the Company's audit committee, the nominating and corporate governance committee, and the compensation committee. |

Richard W. Holmes - Director Mr. Richard W. Holmes was an assistant controller with Duke Power Company (now Duke Energy) from 1971 to 1981. Duke Energy has operated nuclear plants for more than thirty years. While at Duke Power Mr. Holmes was Assistant Controller of the parent company. He was also Treasurer of Eastover Land Company, a $100 million subsidiary of Duke's with interests in coal properties in Kentucky and West Virginia. Concurrently, Mr. Holmes was Treasurer of Western Fuel, Duke's uranium mining project in Wyoming. Mr. Holmes left Duke in 1981 to become Treasurer and Controller of Ogle Resources Inc., an oil and gas company with offshore exploration, drilling and production from 1981 to 1986. At the same time, Mr. Holmes was Treasurer and Controller for a sister company with an investment in in-situ recovery uranium mining in Wyoming. Mr. Holmes received his bachelor's degree in accounting from the University of Wisconsin. He held the position of Senior Auditor at Arthur Andersen & Co. in Chicago, Illinois, from 1968 to 1971. Mr. Holmes was an active certified public accountant from 1971 to 2003. Mr. Holmes has been appointed to the Company's audit committee, and the nominating and corporate governance committee. |

Investor Relations

Shareholders and potential shareholders may be interested in Uranerz Energy's Investor Package, Newsletter or Events Calendar. URZ IR enquiries should be directed to Mr. Derek Iwanaka - see Contact Information at the end of this report, or simply complete this My IR Info Contact Form. Additional company and stock related information is also available at www.Uranerz.com.

Top of Page

About Uranium - price trends, market outlook and ISR mining

Price Trends

Global demand for uranium rose steadily from the end of World War II, largely driven by nuclear weapons procurement programs. This trend lasted until the early 1980s, when changing geopolitical circumstances as well as environmental, safety, and economic concerns over nuclear power plants reduced demand. The production of a series of large hydro-electric power stations also depressed the global market.

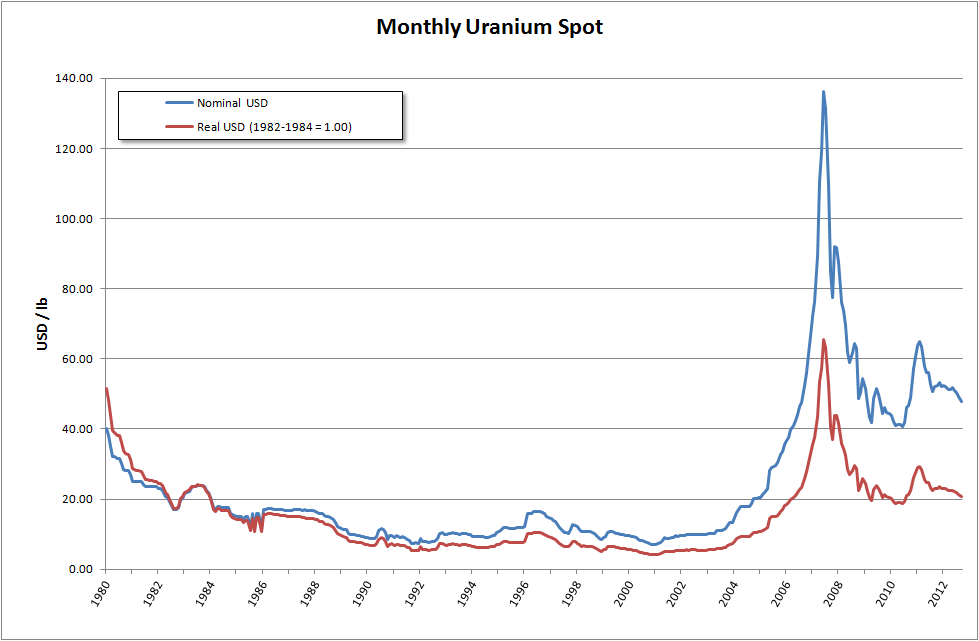

During this time, large uranium inventories accumulated. In fact, until 1985 the Western uranium industry was producing material much faster than nuclear power plants and military programs were consuming it. Uranium prices of over US$40 per pound U308 in the 1970's slid throughout the balance of the century with few respites. By 1981 the uranium import price had fallen to US$32.90, then all the way down to US$12.55 in 1990 as the Cold War ended, to below US$10 per pound for yellowcake by the year 2000. Uranium prices reached an all-time low of US$7 per pound in 2001.

As uranium prices fell, producers began curtailing operations or exiting the business entirely, leaving only a few actively involved in uranium mining and causing uranium inventories to shrink significantly. Since 1990 uranium requirements have outstripped uranium production. World uranium demand is expected to increase steadily throughout the next decade to a peak of over 200 million pounds of yellowcake.

Several factors are pushing both industrialized and developing nations towards alternative energy sources. The increasing rate of consumption of fossil fuel is a concern for nations lacking in reserves, especially non-OPEC nations. The other issue is the level of pollution produced by coal-burning plants, and despite their vastness, an absence of economical methods for tapping into solar, wind-driven, or tidal reserves. Uranium suppliers hope that this will mean an increase in market share and an increase in volume and prices over the long term.

For any commodity, growing demand or lowering supply, especially at the same time, usually spells much higher prices. Uranium prices are also affected by the price trends of energy substitutes, such as oil. From the lows of US$7 per pound in 2001, uranium prices gradually recovered and then accelerated higher starting in 2004. During 2007 and 2008 both oil prices and uranium prices soared to new all-time highs. Higher uranium prices spurred expansion of current mines, construction of new mines and reopening of old mines as well as new prospecting.

Then energy prices in general crashed as the global economy fell into the worst recession since WWII. Oil prices that had far surpassed its 1980 previous peak of $US80 a barrel, fell from its new all-time high price of US$147 a barrel in July 2008 all the way down to US$32 a barrel by December that year, eventually stabilizing in a $60-$80 trading range by October 2009. Uranium prices that made all-time highs of US$137 a pound in 2007, fell to around US$40 a pound and also stabilized higher.

As financial markets started to recover, oil and uranium prices both trended higher again in 2010. This continued up until the tragic events of March 11, 2011, as Japan was struck by one the worst earthquakes in history that registered 9.0 on the Richter magnitude scale. Following this was a tsunami, however the Fukushima nuclear plant accident resulted only after back-up power systems did not work.

Japan is one of the world's most prone nations to earthquakes, aftershocks and tsunamis. One might think they would have the best nuclear technology on the planet. Surprisingly the Fukushima nuclear plant had 40-year old reactors. Fourth generation nuclear reactors, with gravity-fed coolant systems, like those being built in China, might have prevented the accident.

Regardless of whether the nuclear accident was caused by nature or outdated technology, financial markets retreated in fear of how Japan's economy would cope and how this could affect world markets. Flashbacks to Chernobyl and Three Mile Island were cited with false fears that nuclear energy wasn't safe, and politicians promised to scrutinize safety and question future nuclear reactor plans. Oil and energy prices sank on recession fears, with any investment related to nuclear power or uranium being particularly crushed.

Recently oil has been trending higher again, now around US$100 a barrel. However uranium has lagged, still in the low to mid US$50's a pound. Energy traders might be asking if oil's uptrend will continue, and if so will uranium start to outperform oil on a relative basis? Longer-term energy investors might be asking how expected near-term uranium producers like Uranerz Energy will be affected. In addition to uranium production, the company is aggressively drilling to develop known resources and to make new discoveries.

Uranerz appears to be transitioning into a producer at a time when oil prices are strong, with uranium prices perhaps poised to catch up as the nuclear fear factor dissipates further. Good commodity price-trend timing, with Uranerz Energy's status soon changing to producer, and with lots of drilling activity and a growing resource base, all may support more analyst and investor interest.

Market Outlook

| All commodities prices are volatile, changing with geopolitical whims in addition to the standard forces of supply and demand. This is especially true for uranium, with its unique features and only one significant commercial use - the fuel for electrical generating nuclear reactors. The Monthly Uranium Spot chart above shows how uranium prices can spike violently, as they did from 2005 to 2008 at the same time world oil prices soared. |

As the U.S. housing and debt crisis became more apparent going into 2008, and how this would negatively affect financial systems worldwide, energy up-trends quickly reversed and prices plunged on recession fears. Energy prices stayed low until world markets stabilized and started showing signs of recovery in 2010.

Oil prices up-trended again to US$100 a barrel and uranium to US$74 a pound until the Fukushima nuclear accident in March 2011. Then after several months of weakness, oil is again back to US$100 a barrel while uranium lags at around US$54 a pound now. Uranium prices have not kept pace with oil's uptrend, even though the nuclear fear factor seems to have waned lately as investors become more aware of the facts regarding the Fukushima nuclear accident and how newer reactor designs may have prevented the accident. Newer technology and safety standards have resulted in even some hard-line anti-nuclear governments to reconsider nuclear power recently. The many factual advantages of clean nuclear energy over dirty fossil fuel energy shows there is really no commercially viable alternative.

Current uranium demand includes supplying 439 nuclear reactors operating world-wide with 63 currently under construction. Future demand includes 559 reactors now in construction, planned or proposed stages. The demand for clean, low-cost and efficient nuclear energy continues to grow. Emerging economies like China and India have no real choice other than nuclear to meet their energy needs, and these counties are the main driving force in future new reactor demand. The tragic March 2011 Fukushima nuclear accident affected all energy prices for a few months and has inspired safety enhancements, but has not changed the long-term demand for nuclear energy.

Uranium is mined underground or in open pits, then milled into a dry powder called yellowcake, enriched and fuel fabricated into fuel assemblies or bundles, and sold on the uranium market as U308. Technology processes are challenging and complicated. Mining methods employed are: 59% conventional underground and open cast and 41% in-situ leaching.

Approximately 100 uranium mines are in different stages of development in 25 countries. Canada, Australia and Kazakhstan account for 62% of world uranium production. Other important producers of 1000 tonnes or more per year include: Namibia, Russia, Niger, Uzbekistan and the United States. The largest uranium mines are: Canada's McArthur River, Australia's Ranger and Olympic Dam, Russia's Krasnokamensk, and Namibia's Rossing.

For many years Canada was the largest exporter of uranium ore, however in 2009 Kazakhstan became the largest uranium producing country with 27% of the 50,572 tonnes produced worldwide. Cameco's large and very high-grade Cigar Lake mine in Saskatchewan is expected to start production in 2013, and this lead may again return to Canada.

ISR Mining

Uranerz Energy specializes in ISR - the In-Situ Recovery mining process. As of December 2011, ISR's portion of global uranium mine production has increased to 41% according to the World Nuclear Association. The company's executive operations team has over 60 years of combined experience with ISR mining in Wyoming, and nearly all uranium mining in the United States and Central Asia employs this method.

ISR is a low cost mining process that uses a 'leaching' solution to extract uranium from underground ore bodies. The 'leaching' agent, which contains an oxidant such as oxygen with sodium bicarbonate (commonly known as baking soda), is added to the native groundwater and injected through wells into the ore body in a confined aquifer to dissolve the uranium. This solution is then pumped via other wells to the surface for processing -- resulting in a cost-efficient and environmentally friendly mining process.

- ISR-amenable deposits located in aquifers with underground permeable rock, i.e., sandstone hosted

- Ground water fortified with oxidizing agents pumped into deposit ('in-situ') dissolving the contained uranium

- Dissolved uranium (U3O8) solution pumped to surface to be processed into yellowcake

- Yellowcake shipped to conversion facility

- Low Capital Costs

- Faster Mine Development

- Low Operating Costs

- Environmentally Friendly

- No Waste Rock, No Tailings Pond

- Profitable on Lower Grade Uranium Deposits

- Small Work Force (low labor costs)

Top of Page

Uranerz Energy Comments & Observations - our newsletters and disclosure

Our Newsletters

- Mon, Jan 16, 2012 - Why Uranium, Why Uranerz Energy

- Mon, Nov 28, 2011 - More Uranium Up-Signs; T.HAT Buyout Heats Up; URZ Mine Construction On Schedule

- Wed, Oct 19, 2011 - Fall Rally, Headline Risk vs. Long-Term Value, Uranium Bottom?

- Fri, Sep 02, 2011 - Uranerz Energy - Company Interview

- Tue, Jul 26, 2011 - America's Next Uranium Producer, Uranerz Receives Final NRC Permit

- Mon, Jun 20, 2011 - Uranerz To Be Added To Russell Indexes

- Tue, May 24, 2011 - Will Uranerz Be Inducted To The Russell 2000 Index Next Month?

- Sun, May 01, 2011 - The Fukushima Time Machine For Uranium Value Investors?

- Wed, Mar 30, 2011 - Uranium Stocks After Japan Quake, Deep Dip Within Long-Term Uptrend

- Wed, Feb 16, 2011 - Imminent Final Permit To Commence Construction Of WY Uranium Mine

Disclosure

Uranerz Energy Corporation is a Featured Stock at InvestorsGuru.com and pays a monthly corporate services fee for internet advertising and distribution of company updates. This includes display ads, bulletin boards, reports and news by email, plus other types of company awareness via Investors Guru global media network of small-cap stock websites, social sites, mobile sites, video channels and syndicated news blogs.

Information contained in this report was compiled from, or based on, various sources believed to be correct, however should not be relied upon without verifying with the company and your advisors. Sources include our website's financial data quote feeds, the company's website and news releases, plus various news, encyclopaedia or other online sources in the public domain.

Please note that nothing in this report should be taken as a recommendation in any way, and that everything from InvestorsGuru.com is subject to the terms of our Privacy Policy and Disclaimer.

Contact Uranerz Energy - investor relations, administrative, executive operations and more info links

| Investor Relations | Executive Operations | ||

| Phone: | (800) 689-1659 ext. 1 | Phone: | (307) 265-8900 |

| Contact: | Derek Iwanaka, Manager of IR | Fax: | (307) 265-8904 |

| Email: | DIwanaka@Uranerz.com | Contact: | Dennis Higgs, Executive Chairman |

| Website: | www.Uranerz.com | Email: | DHiggs@Uranerz.com |

| Administrative | Contact: | Glenn Catchpole, President & CEO | |

| Phone: | (604) 689-1659 | Email: | GCatchpole@Uranerz.com |

| Fax: | (604) 689-1722 | Contact: | George Hartman, Exec. VP & COO |

| Email: | Info@Uranerz.com | Email: | GHartman@Uranerz.com |

| Address: | Suite 1400-800 West Pender St, | Address: | 1701 East "E" St. P.O. Box 50850 |

| Vancouver, British Columbia, Cda V6C 2V6 | Casper, Wyoming, USA 82605 - 0850 | ||

More Info Links

- Get Uranerz Energy's News by Email - as it's released

- Request Uranerz Energy's Investor Package, Newsletter etc.

- Visit our Uranerz Energy Stock Research Portal

- Download Uranerz Energy's December 15, 2011 PDF Presentation

- Watch BNN's Interview with Uranerz Energy's CEO

No comments:

Post a Comment