(TSXV: PCT, BAT, GCM) - How To Ride Colombia’s Next Investment Wave?

Have you ever raised your voice in anger – and then had to apologize the next day for overreacting?

The same scenario occurs repeatedly in the market. There is an emotional surge by the herd, followed by an aggressive retreat. Each time this happens a small group of savvy investors profit.

When a solid stream of good news flows into a sector, investors pile in. As the herd gains size and momentum – it becomes easily spooked. Any sharp noise will cause a reverse in direction. As the herd skitters backwards, they are not reacting to the noise: they are reacting to the reaction to the noise.

Case in point: Colombia.

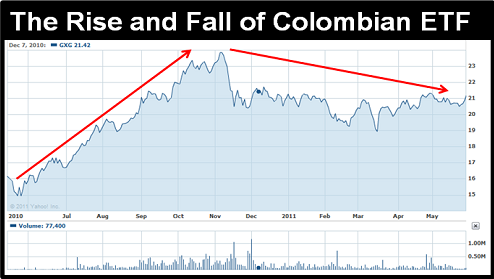

Through all of 2010, Colombia was the darling of the investment community. The World Bank rated them the most improved business environment. Bullish headlines dominated the mainstream media: “Colombia Seeks Oil Investment”, “Wall Street Cheers Santos”, “Investment Dollars Flood into Colombia”.

And then the bloom went off! There was a scandal at the drug enforcement agency, inflationary pressure, a high profile kidnapping and massive flooding of agricultural areas. In truth, none of these events have any great importance to an international investor, but it was enough to trigger the stampede.

After gaining 40% in Q3/Q4 2010, Colombian-based exploration and production companies declined 1% over Q1/11. During the same period, the Colombian Stock Exchange experienced a 7% decline.

The fact is Colombia contains trillions of dollars of oil, gas, timber and gold – a veritable smorgasbord of the world’s most desired dishes.

Finance Minister Juan Carlos Echeverry affirmed that foreign direct investment is projected to exceed $10 billion in 2011, up from $6.76 billion in 2010.

All the economic indicators suggest that Colombia is about to get hot – again.

Mature companies like Pacific Rubiales (TSX: PRE), Ecopetrol (NYSE: EC) and Canacol Energy (TSX: CNE) are poised for a good run but with a combined market cap of $8.5 billion they aren't likely to morph into triple baggers overnight.

Here are three junior companies that have been sold off in the reverse Colombian stampede - and appear poised to rebound.

Each of them has a rapidly growing resource base and is entering the phase of development which has typically been the most profitable for shareholders.

Prima Colombia Hardwood (TSXV: PCT) is a new company run by Donald and Harold Hayes – two brothers who were early helicopter loggers in British Columbia, Canada.

PCT has an exclusive 15-year lease to selectively harvest 3.1 million cubic meters of sustainable tropical premium Colombian hardwood.

Tropical Hardwood sells for about $300 a cubic meter, more than double the price of Pine and Hemlock.

On May 2, 2011, PCT finalized a formal agreement with Pacific Lumber to help Prima expand its timber concessions. The agreement anticipates the potential of a ten-fold increase to 31.5 million cubic meters.

Production units are built around the lifting capabilities of a single helicopter. The additional concessions will give PCT a potential 10-helicopter harvesting force.

Operational timelines forecast log sales by Q3, 2011.

Global demand for hardwood has increased 2,500% over the last four decades.

With a market cap of $47 million, PCT is currently trading at $0.17 – down 53% from its 52-week high of $0.365.

Batero Gold (TSXV: BAT) is a well-funded Colombian gold explorer with about $10 million in cash.

It is executing an aggressive exploration and drill program aimed at generating a compliant NI-43-101 resource by Q4, 2011.

Phase 1 drill program comprising 16,000 meters is completed.

Phase 2 drill program is well underway, comprising 24,000 meters. There are currently 8 drill rigs turning and about 250 employees on the ground, including 23 geologists.

Batero has inherited a decade of “on the ground” social and community work and appears to have strong local support.

Comprehensive infrastructure and access is in place including roads, water and power. The project ranges in elevation between 1600m and 1950m in elevation.

La Cumbre porphyry gold and copper mineralization has been intercepted at or near surface. An even higher-grade zone of mineralization has been intersected at or near surface up to 200+ metres depth; the porphyry remains open to the NNW and SSE and at depth.

With a market cap of $118 million, BAT is currently trading at $2.48 – down 62% from its 52-week high of $6.57.

Gran Colombia (TSXV: GCM) is the largest underground gold and silver producer in Colombia with six underground mines in operation. It is also developing a large-scale, open-pit gold and silver mine at Marmato.

On June 13, 2011 Gran Colombia completed of a merger with Medoro Resources Ltd. (TSX: MRS, MRS.WT).

"The merger creates Colombia's premier gold company with an attractive portfolio of gold and silver assets, said CEO Serafino Iacono.

The merger provides better liquidity and operational synergies. Current production of 109,000 gold ounces in 2011 is forecast to grow to over 630,000 by 2016.

Estimated selling and administrative expense are projected at $3-5 million annually.

The new company is well positioned to bring increased shareholder value through strong production growth and decreased mining costs.

With a market cap of $304 million, GCM is currently trading at $0.78 – down 69% from its 52-week high of $2.49.

Colombia’s Recent Credit Rating Upgrades

On May 31, 2011 Colombia was upgraded to an investment-grade credit rating by Moody's. This follows an upgrade from Standard and Poor’s in March, and opens the door to senior institutional funds - which require two investment grade credit ratings.

“A herd appears to act as a unit”, explains evolutionary biologist, W. D. Hamilton, “but its function emerges from the uncoordinated behavior of self-seeking individuals”.

Colombia’s enormous riches and business-friendly environment ensure that investors will come back to Colombia. Running at the head of that herd could be very profitable.

More at: www.PrimaHardwood.com, www.BateroGold.com, and www.GranColombiaGold.com.

Investors Guru Small Cap Stock Observer publishes interesting contributor articles in addition to its own content. We have not verified any of the above details.

Please note that nothing in this report should be taken as a recommendation in any way, and that everything from InvestorsGuru.com is subject to the terms of our Privacy Policy and Disclaimer.

No comments:

Post a Comment